- #Quicken mint bills for free#

- #Quicken mint bills full#

- #Quicken mint bills software#

- #Quicken mint bills download#

- #Quicken mint bills windows#

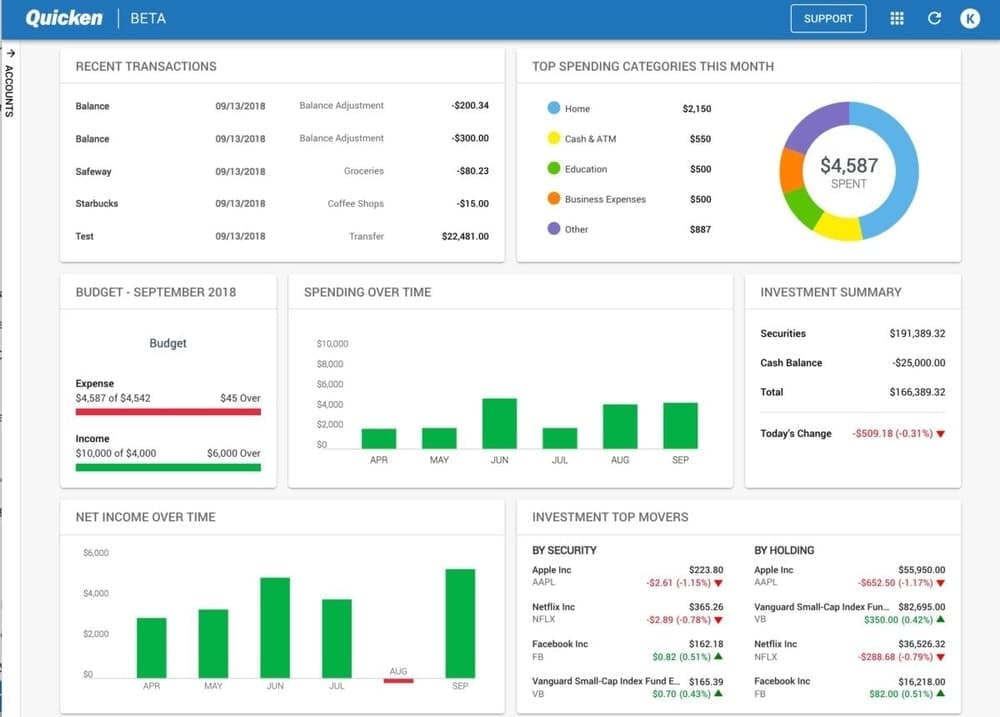

Quicken is a subscription-based financial management product that offers four different service packages. They make money by referring products you might like and running ads. Great news: Mint is free! No signup fees, service fees, or hidden fees. Net worth is a powerful summary of your financial picture, and seeing it plain as day on your dashboard can be very satisfying and motivating. It shows the total value of your assets and debts, so you know exactly what you’re working with. Mint tallies up the data from all connected accounts and calculates your net worth. Pretty neat, right? They offer recommendations for bank accounts, investment products, insurance policies, and loans, as well. They even show you the annual net value of the rewards and the recommended credit score for qualification. It also suggests products that can help you save.įor example, if you answer a few questions about your finances and the type of rewards you’re interested in, they’ll suggest credit cards that fit the bill. Savings TipsĪdditionally, Mint analyzes your spending habits and makes recommendations to help you save money. This helps you stay aware and nip inaccuracies in the bud. They keep you on alert by sending notifications if TransUnion receives new info for your report. Mint interprets your credit score, explains how it’s calculated, and offers tips for improving it.

#Quicken mint bills for free#

How often do you check your credit score? With Mint, you can check in for free anytime, and you get more than just a number. So, although you can keep track of bills in Mint, you can’t pay them using the program. Note that Mint used to support a bill payment function, but it was discontinued in June 2018.

#Quicken mint bills full#

Because your full financial picture is accessible in the same place, it’s easy to verify that you have the money to cover an upcoming payment. They send notifications when your due date approaches, so you never miss a beat. That means you never have to check another app or site for your balance. It’s easy to review transaction history so you know exactly what your money is doing. It lets you track performance and compare to market benchmarks to make sure you’re on target to hit your investment goals. Like some other programs (such as Personal Capital), Mint helps you track your investments by displaying your asset allocation for all your investment accounts in one place. Want to buy a house or save for that vacation? Mint can help you get there. Name your goal, choose a target date, and Mint will tell you how much you need to save each month to get there. Mint also lets you set and track financial goals. This is the same with any good expense tracker they’re not magic. For example, if you buy gardening supplies, groceries, toiletries, and clothes at a trip to Walmart, Mint can’t know that. In some situations, you’ll have to manually split a transaction into categories.

#Quicken mint bills software#

Sometimes you may have to change the category Mint assigns a transaction, but over time, the software will remember those changes and start getting it right. You can look at annual trends or even look at all the data since you started using Mint. You’re not just limited to the month, either. Mint has cool graphs to help you visualize your spending trends by category, by merchant, or over time. Then, simply create budgets for each category and track your progress over the month.

You can use the built-in categories or create custom categories to suit your unique situation. It imports your transactions from connected accounts and sorts them into spending categories. Mint is a powerhouse budgeting and expense tracking tool. Mint’s Key Features Budgeting and Expense Tracking In our opinion, the platform’s best feature is its customizable budgeting system. The program uses the data to summarize your financial picture, track spending, and monitor bill payments. Mint lets you quickly connect your bank, investment, and credit accounts.

#Quicken mint bills download#

You can use the desktop site or download the mobile app.

#Quicken mint bills windows#

Mint, owned by Intuit (who used to own Quicken), is a financial tracking tool available for Windows and Mac. In this review, we’ll compare Quicken and Mint and help you decide if one of them is a good fit for your financial management needs.

Mint is just one free budgeting app that gives Quicken a run for its money. In recent years, there’s more competition on the scene.

Some people are set with a good old-fashioned pen and paper, but others prefer a personal finance program or app to do the heavy lifting.įor a long time, Quicken was the major player in that arena. If you’re serious about budgeting and tracking your spending, you likely have some tools in your arsenal that help you tackle the task. For more about our advertising policies, read our full disclosure statement here. Should you click on these links, we may be compensated. This article may contain references to some of our advertising partners.

0 kommentar(er)

0 kommentar(er)